This article was adapted from one of our previous virtual FP&A Summits, featuring Amit Kurhekar, Head of Data at MoneyLion.

Unless you’ve been consistently offline over the last few years, you’ll know that the financial industry is undergoing a significant transformation driven by AI and machine learning technologies.

This revolution isn’t just about adopting new technologies but about changing how financial services and processes are delivered and experienced by consumers.

In this article, we’ll explore some of the most compelling AI and ML strategies in finance with use cases to show how they work in real-life scenarios.

Whether you're a financial professional or simply interested in the evolving landscape of FinTech, this article offers valuable insights into the intersection of finance, AI, and digital transformation.

Case study: Day in the life of ‘financially savvy’ John

Let me introduce you to John. He considers himself to be very financially savvy, he’s in his 30s, intelligent and he uses a smartphone like so many of us.

One day, he receives a notification on his phone that reads:

“John, your utility bill of $50 is due tomorrow. Do you want to pay now?”

A few seconds later, another notification comes through,

“John, your net-worth increased by 1% last week with Apple stock making the maximum gains.”

John gets on with his day. He goes to work, enjoys chatting to his co-workers, and then in the afternoon, he notices yet another notification on his phone. This one says,

“John, you have excess balance in your savings account. Invest 20% of the amount to earn an extra 8% vs keeping in your savings account. Invest now?”

These are smart notifications and nudges and in today’s financial world, it's a reality. If you’re not using technology to help improve your finances, you’re missing out.

By embracing AI and ML, you can make a huge impact not just in your role but also in your daily life.

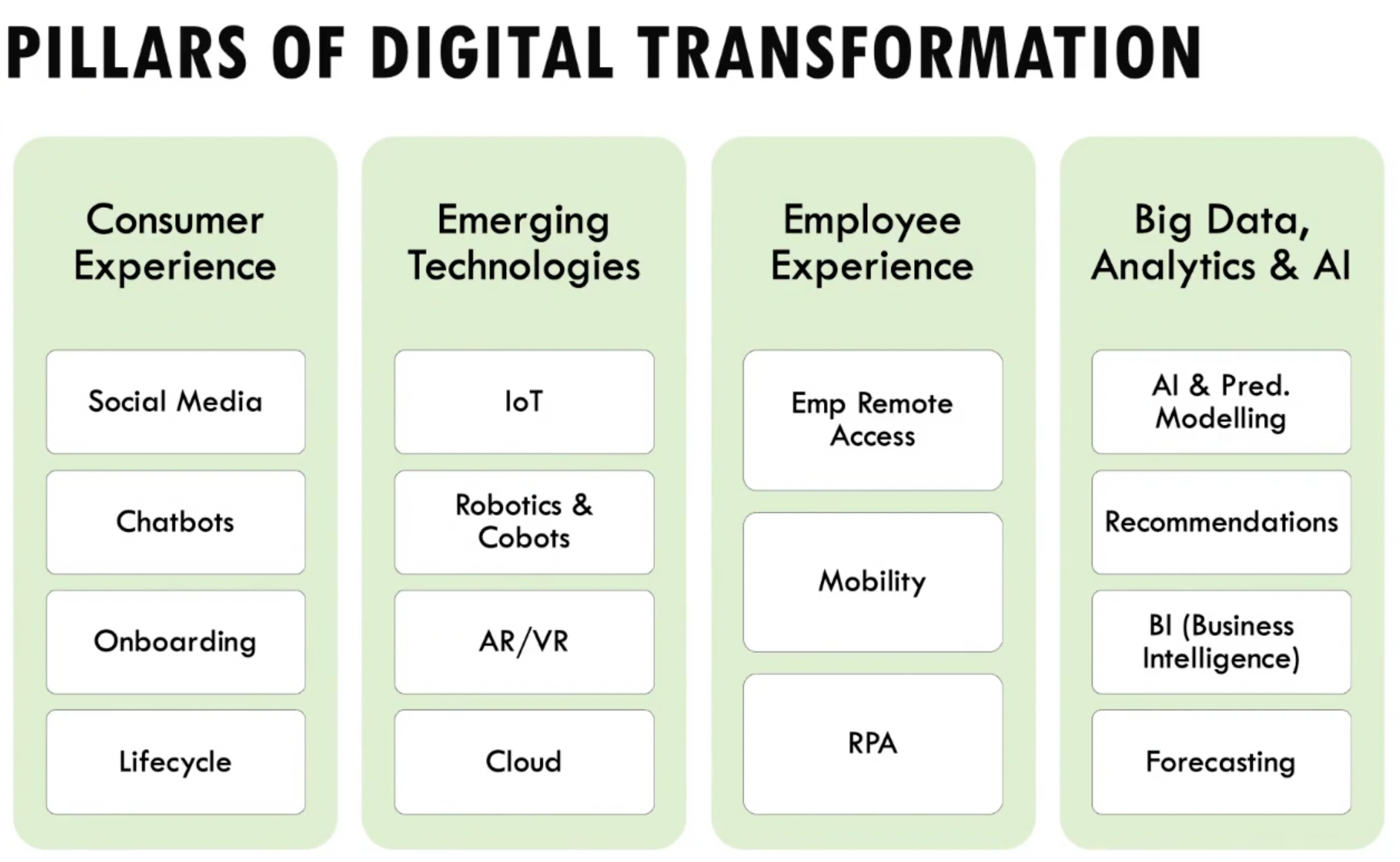

Pillars of digital transformation

Within digital transformation, there are emerging technologies. Most companies are utilizing these emerging technologies to drive and improve consumer experiences. These include things like internet of things (IoT), robotics, AR/VR and Cloud.

Before 2020, not many people were working online or working from home, and then almost the majority of the IT workforce moved into remote working. The transformation from almost everyone working in-office to everyone working remotely because of Covid meant that many people had to embrace technology in new ways. There was a huge mobilization of IT and IT infrastructure.

I think that both AI and ML are critical pieces that are enabling today's world. So, a part of that could be coming as simple as receiving smart nudges throughout the day on your smartphone or you could even have nudges to help you forecast numbers for your financial forecast.

Become a member to see the rest

Certain pieces of content are only to AIAI members and you’ve landed on one of them. To access tonnes of

articles like this and more, get yourself signed up.

Already a member? Awesome Sign in

#Ai, #Amp, #Analytics, #Apple, #Ar, #Article, #Articles, #ArtificialIntelligence, #CaseStudy, #Cloud, #Companies, #Consumers, #Content, #Covid, #Data, #DigitalTransformation, #EmergingTechnologies, #Experienced, #ExpertInsights, #Finance, #Finances, #Financial, #FinancialIndustry, #FinancialServices, #Fintech, #Forecast, #How, #Impact, #Industry, #Infrastructure, #Insights, #Internet, #InternetOfThings, #IoT, #It, #ITInfrastructure, #Landscape, #Learning, #Life, #MachineLearning, #Members, #MembershipContent, #Ml, #Notifications, #One, #Phone, #Pieces, #Remote, #REST, #Robotics, #Savings, #Smartphone, #Study, #Summits, #Technology, #Transformation, #VR, #Vs, #Work, #Workforce, #WorkingFromHome

Published on The Digital Insider at https://is.gd/QOy50y.

Comments

Post a Comment

Comments are moderated.